Some veterans are finding it difficult to obtain a home in today’s market. According to the National Association of Realtors (NAR):

“Conventional conforming mortgages (mortgages that conform to guidelines set by Fannie Mae and Freddie Mac), accounted for 74% of mortgages obtained by homebuyers in May 2021, an increase from about 65% during 2018 through 2019…The share of VA-guaranteed loans has also decreased to 7% in May 2021 from about 10% in past years.”

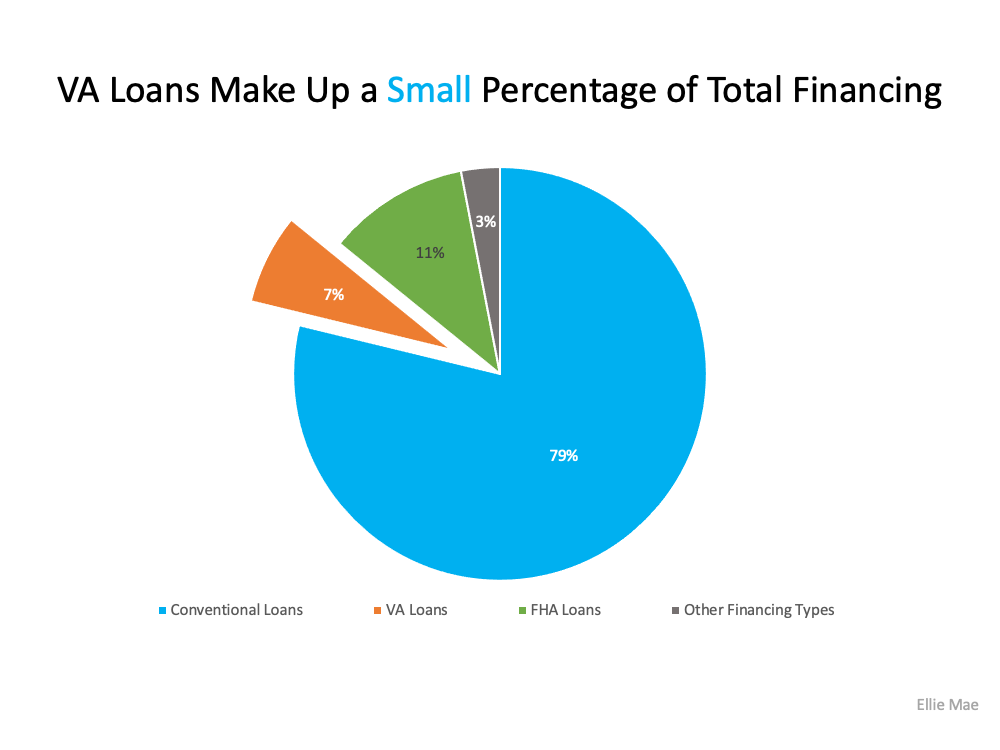

Recent data in the latest Origination Insight Report

from Ellie Mae sheds light on the continuation of this trend. Below, we can see just how small of a share of total financing VA loans made up in June of 2021, according to that Ellie Mae report: The drop in VA loan usage can be attributed to the difficulties veterans continue to face when buying a home. The NAR article elaborates:

The drop in VA loan usage can be attributed to the difficulties veterans continue to face when buying a home. The NAR article elaborates:

“It is extremely difficult for FHA/VA buyers to get accepted in a multiple offer situation. They are on the bottom of the hierarchy.”

One contributing factor is that buyers with VA loans can’t waive certain contingencies. However, just because a certain contingency must be present for a particular buyer doesn’t mean that buyer’s offer shouldn’t be considered.

What Should Sellers Do To Help Create a Level Playing Field?

As a seller, it’s important to consider every offer in front of you regardless of loan type. If you’re selecting an offer because some contingencies are waived, keep in mind that it doesn’t always mean the offer is what’s best for you.

Buyers who can’t waive specific contingencies may adjust other terms in their offer to make it more appealing to sellers. This may depend on several factors, including their loan type and location, but a motivated buyer and their agent will do everything they can to present an offer that’s as appealing to you as possible.

Ultimately, you should make sure you take time to really understand the terms of their offer and see the big picture. Working with a driven buyer who’s motivated to purchase your house may provide a better opportunity for you to reach your overall best option and what’s most important to you.