It’s impossible to research the subject of buying a home without coming across a headline declaring that the fall in home affordability is a crisis. However, when we add context to the most recent affordability statistics, we soon realize that, though homes are less affordable than they have been over the last few years, they are more affordable than they historically have been.

Black Knight, a premier provider of data and analytics for the mortgage industry, just released their latest Monthly Mortgage Monitor

which includes a new analysis of the affordability situation. Here’s what the report reveals:

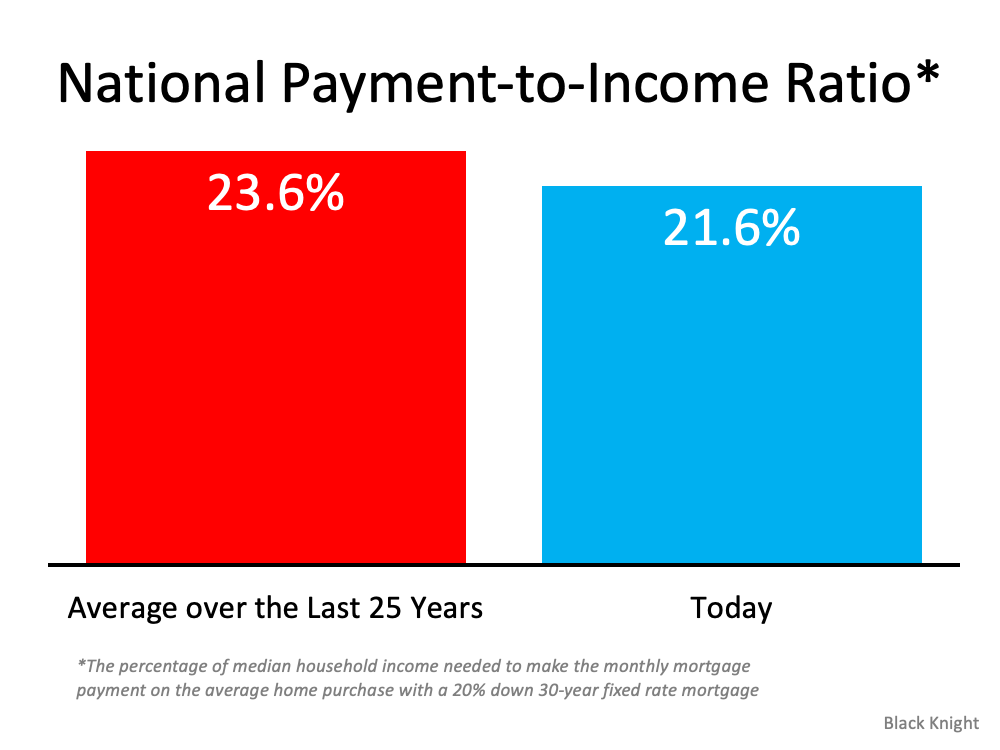

“The monthly payment required to purchase the average priced home with a 20% down 30-year fixed rate mortgage increased by nearly 20% (+$210) over the first nine months of 2021, . . . It now requires 21.6% of the median household income to make the monthly mortgage payment on the average home purchase, the least affordable housing has been since 30-year rates rose to nearly 5% back in late 2018.”

Basically, the report shows that homes are less affordable today than at any other time in the last three years. However, in a previous report

earlier this year, Black Knight calculated that the percentage of the median household income to make the monthly mortgage payment on the average home purchase over the last 25 years was 23.6% (see graph below): Today’s payment-to-income ratio is more affordable than the average over the last 25 years. Given that context, we can see that American households still have the same ability to be homeowners as their parents did 20 years ago.

Today’s payment-to-income ratio is more affordable than the average over the last 25 years. Given that context, we can see that American households still have the same ability to be homeowners as their parents did 20 years ago.

This confirms the recent analysis of ATTOM Data resources where Todd Teta, Chief Product and Technology Officer, explains:

“The typical median-priced home around the U.S. remains affordable to workers earning an average wage, despite prices that keep going through the roof. Super-low interests and rising pay continue to be the main reasons why.”